Most new york city apartment buildings have flat roofs but the material varies often depending on how old the roof is.

Writing off roof repair on apartment building.

Reasonable and necessary repair costs for your rental property are tax deductible.

They can either continue to depreciate the cost of the replaced component or they can fully deduct the unrecovered cost of the component in the year it is replaced.

For example if you classify a 10 000 roof expense as a repair you get to deduct 10 000 this year.

Maintenance doesn t always involve fixing something that s broken but it gets to the idea of keeping the property in its original condition and in the long run a regular maintenance.

Allows businesses to deduct depreciable equipment including the cost of re roofing projects as an immediate write off against that year s earnings up to the full replacement cost.

Each year tax professionals who deal with real estate must evaluate the most recent building expenditures and determine which items should be written off as a repair expense or capitalized.

Describe in your own words.

According to wayne bellet of bellet construction co.

The most common and often significant item that is evaluated is roofing related work.

I wrote off the cost of a new roof on my rental house as an expense and deducted the total cost of less than 10 000 on this tax return instead of deducting depreciation you need to file an amended return and correct it.

There s an immediate deduction for the old roof which offsets the downside of having to depreciate the new roof over several years.

Dear name house owner i would like to draw your attention to the weak position of the roof and ceiling.

A repair is any work that restores the property to its original condition.

Rainy season is about to set in and the seepage is very likely to occur in the coming rainy season.

In essence the landlord can write off the cost of the old roof thus removing that part of the cost from the building s depreciation schedule.

Give reliable roofing a call at 815 893 0149 for more information about our roof replacement and installation services.

Permits businesses to deduct the full cost of their roof replacement in the year completed instead of depreciating over 39 years as was required under previous law.

Roof ceiling repairing request to landlord.

Because you can deduct the cost of a repair in a single year while you have to depreciate improvements over as many as 27 5 years.

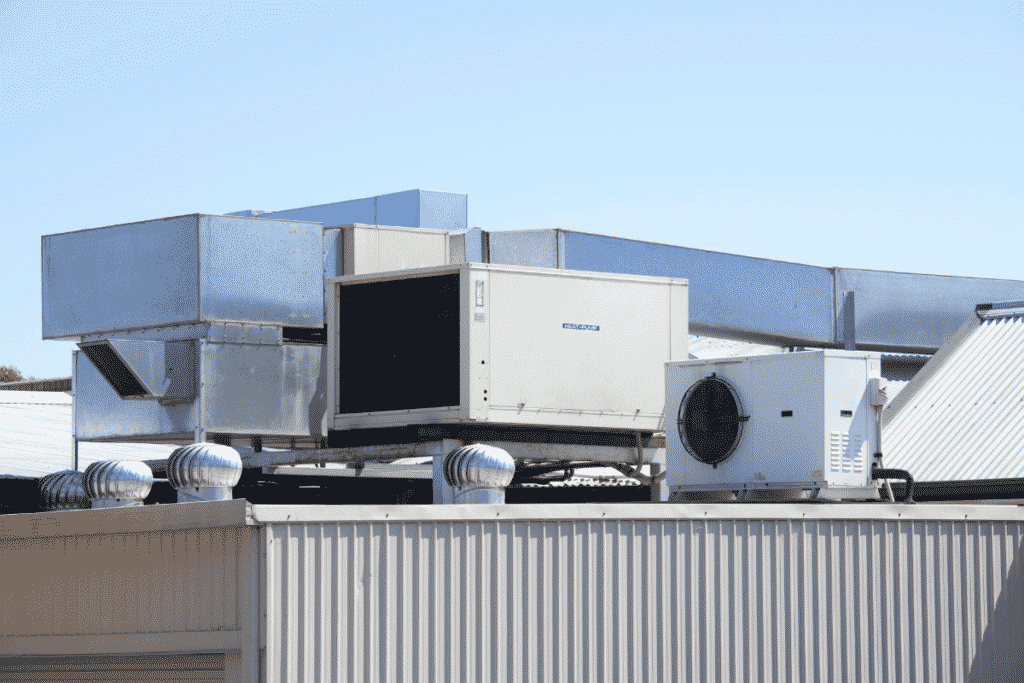

Complex irs regulations give owners of apartment buildings and other commercial structures two options when they dispose of a building s structural components such as a roof hvac unit or windows.